- Claiming medical expenses on taxes 2020 how to#

- Claiming medical expenses on taxes 2020 professional#

The tax reliefs referred to are those currently applying in the United Kingdom to UK Tax Residents.

The Financial Conduct Authority does not regulate tax advice. Legal & Medical Investments Ltd is authorised and regulated by the Financial Conduct Authority. We would always suggest that you get specialist advice in this area.

It has been revamped and updated for accuracy and comprehensiveness in March 2023. This article was first published in August 2016. Will you be submitting your tax-deductible expenses this year? Let us know by adding a comment below. This article is based on our understanding of current legislation. Tax is dependent on your own circumstances and personal situation, and is subject to changes based on UK legislation and taxation regime. You can contact Vincenzo, also known as Vinny, by emailing to discuss your current financial situation and how you can plan accordingly for a tax-efficient future. It seems not a year goes by without the Chancellor tinkering with taxation in some way, or another to either close off opportunities or indeed open up new ones so your adviser can help! They will certainly take into account your earnings, the source of those, any allowances and possibly those of your spouse/partner and children too.

However, you should expect an IFA to help plan for your future by discussing your personal tax situation. What can an independent financial adviser do?Īccountants can help with submitting returns and associated work. Should I use an accountant?įilling out any forms to send to the HMRC can be complex, and it is advisable to engage the services of an accountant or tax adviser to help with what you can and can’t claim. These days “passive income” is all the rage with extra earnings on the “side”, for example, rental income on a Buy to Let property or maybe Youtube/Instagram fees for being such an amazing influencer – in instances such as these, or similar you need to declare it. HMRC will allow you to claim expenses that have arisen in the previous four years from the current tax year we are in 1 : You may need to scroll left and right if you’re viewing the table below on a small screen. Any amounts over £2,500 you will need to claim via your self-assessment. If the total costs of these expenses are under £2,500 in a tax year, there is a simple form to complete for each tax year you want to claim in.

Claiming medical expenses on taxes 2020 how to#

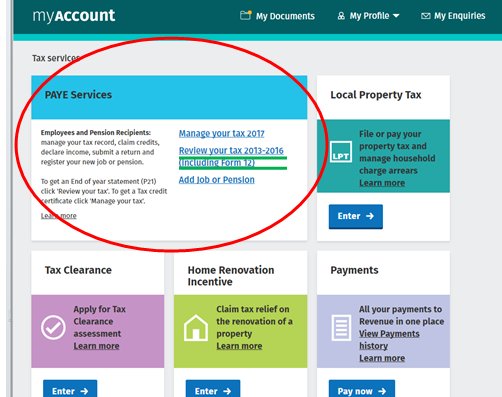

The best place to see how to claim expenses is on the HMRC website. Due to a high court judgement, you can now claim the cost of exams, which is compulsory to your training contract. Therefore, you were unable to claim exams as expenses. When it comes to exams before 2010, HMRC saw these as career progression. Still, studying? What about exams that you’ve already paid Perhaps a stethoscope is essential for your particular role, or a pair of those on-trend rubber clogs that appear a universal must for medical professionals?!

Claiming medical expenses on taxes 2020 professional#

However, you can claim mileage if you need to travel to that super important training or professional development event in another city, which is a bonus given the rising cost of living. Your commute to and from your workplace is excluded. Maybe you are already a member of one of these, or you are putting off becoming a member due to costs, if this is the case, it’s worth clicking the link below.Īpproved professional organisations and learned societies > There is a long list of professional bodies approved for tax relief. Professional Fees and Subscriptions are not restricted to the BMA, GMC & MPS. Plus, it’s great to find out you can claim back the cost of something, especially when you find it relates to the fact you are just doing your job! What expenses can I claim for? The good news is that you can claim tax relief on some of those costs.Ĭlaiming back expenses may seem time-consuming and too much effort, but it’s important to remember that many small costs can add up to quite a significant sum of money. As a medic, during an average working day, you often incur expenses to enable you to carry out your role as a medical professional.

0 kommentar(er)

0 kommentar(er)